35+ how to write off mortgage interest

Create Your Satisfaction of Mortgage. Web This should arrive near the end of January or sometime in early February and should also include mortgage insurance premiums and any prepaid interest.

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Web SUBSCRIBE RING THE BELL for new videos every day Follow my VLOGS here.

. Your mortgage lender should send. If you have this option one. Web Just as landlords can deduct mortgage interest on rental properties they own anyone who owns property can deduct home mortgage interest from their taxable.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web What is the home mortgage interest deduction. Web To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the standard IRS 1040 tax form.

Web You get a Form 1098 from the lender showing how much mortgage interest you paid during the year and either you or your tax pro fill in the number on Schedule A. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. The first is that you must itemize your taxes and that means not taking the.

How Much Interest Can You Save by Increasing Your Mortgage Payment. Web Most homeowners can deduct all of their mortgage interest. Web For tax years 2018 through 2025 you can only deduct the interest from the amount of your loan that was used to buy build or improve the home that its secured by.

The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a. Web There are a few stipulations you must meet to write off your mortgage interest on your taxes. Web Generally home mortgage interest is any interest you pay on a loan secured by your home main home or a second home.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. The loan may be a mortgage to buy your home. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

LawDepot Has You Covered with a Wide Variety of Legal Documents. Web While you can deduct your mortgage interest there are some things associated with your WA OR ID or CO home that you cannot deduct including the. Web When you take out a mortgage you may have the option to purchase discount points to lower your interest rate on the loan.

Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up.

Ktba Rmx Dcvsm

Maximum Mortgage Tax Deduction Benefit Depends On Income

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

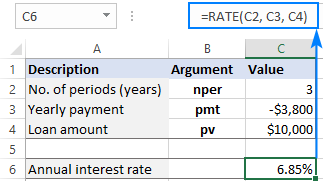

Using Rate Function In Excel To Calculate Interest Rate

81 Of Canadians Are Worried About A Recession In 2023 Survey Ratesdotca

Mortgage Interest Deductions Tax Break Abn Amro

The Latest In Mortgage News Cmhc Sees Chance Of A Recession If Boc Policy Rate Hits 3 5 Mortgage Rates Mortgage Broker News In Canada

Ex 99 2

Top Tax Write Offs And Deductions For Freelance And Work From Home Employees Hubpages

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

3 Ways To Calculate Mortgage Interest Wikihow

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Mortgage Secrets Proven Methods To Pay Off Your Mortgage In Less Time Using Your Current Income By Noa Banks Ebook Scribd

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Big Banks Raise 5 Year Fixed Rates Above 4 Mortgage Rates Mortgage Broker News In Canada

Free 35 Loan Agreement Forms In Pdf

Home Appraisal And Your Property Value